santa clara property tax rate

Santa Clara has to adhere to provisions of the California Constitution in establishing tax rates. TAX RATES The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Yearly median tax in Santa Clara County.

. Learn all about Santa Clara County real estate tax. California State Sales Tax. Santa Clara County collects on average 067 of a propertys.

Free Case Review Begin Online. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Santa Clara County Sales Tax.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. See how 1 assessed-value property taxes are distributed. Property Tax Rates for Santa Clara County The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters.

Tax Rates by Tax Rate Area Numbers TRA Assessed Valuations for time period indicated. Property Tax Distribution Schedule. Santa Clara County property tax rate.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The bills will be available online to be viewedpaid on the same day. Santa Clara County has a property tax rate of 067 which is lower than the state average of 074.

Sunnyvale City Sales Tax. It limits the property tax rate to one. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local.

Total tax rate Property tax. Uncover Available Property Tax Data By Searching Any Address. Tax Increment Loss by Project and by.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. The Santa Clara County assessors office can help you with many of your property tax related issues including. Santa Clara County property tax rate.

Property Tax Appraisals The Santa Clara County Tax Assessor will appraise. Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

On your tax bill you will see 1. In reality tax rates cant be raised until the public is first alerted to that intent. Countywide Property Tax 1 Allocation.

Based On Circumstances You May Already Qualify For Tax Relief. Santa Clara County Property Tax. Look at the monthly tax distribution schedule.

Table of Delinquency Ratings. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate.

The median property tax in Santa Clara County California is 4694 per year for a home worth the. Santa Clara County collects on average 067 of a. Property Tax Distribution Charts.

For every 100000 in property values the county will collect 4694 in. The median property tax in Santa Clara County California is 4694 per year for a home worth the. Ad See If You Qualify For IRS Fresh Start Program.

It also limits increases on assessed. Yearly median tax in Santa Clara County.

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Why Buy Now Lennar House Styles New Homes

Understanding California S Property Taxes

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Tuition And Fees Over Time Trends In Higher Education The College Board Tuition Native American Spirituality College Board

Ownership Interests Fee Simple Improve Condominium

Bay Area Real Estate Buyers Cooling Real Estate Buyers Alameda San Mateo

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Santa Clara County Ca Property Tax Calculator Smartasset

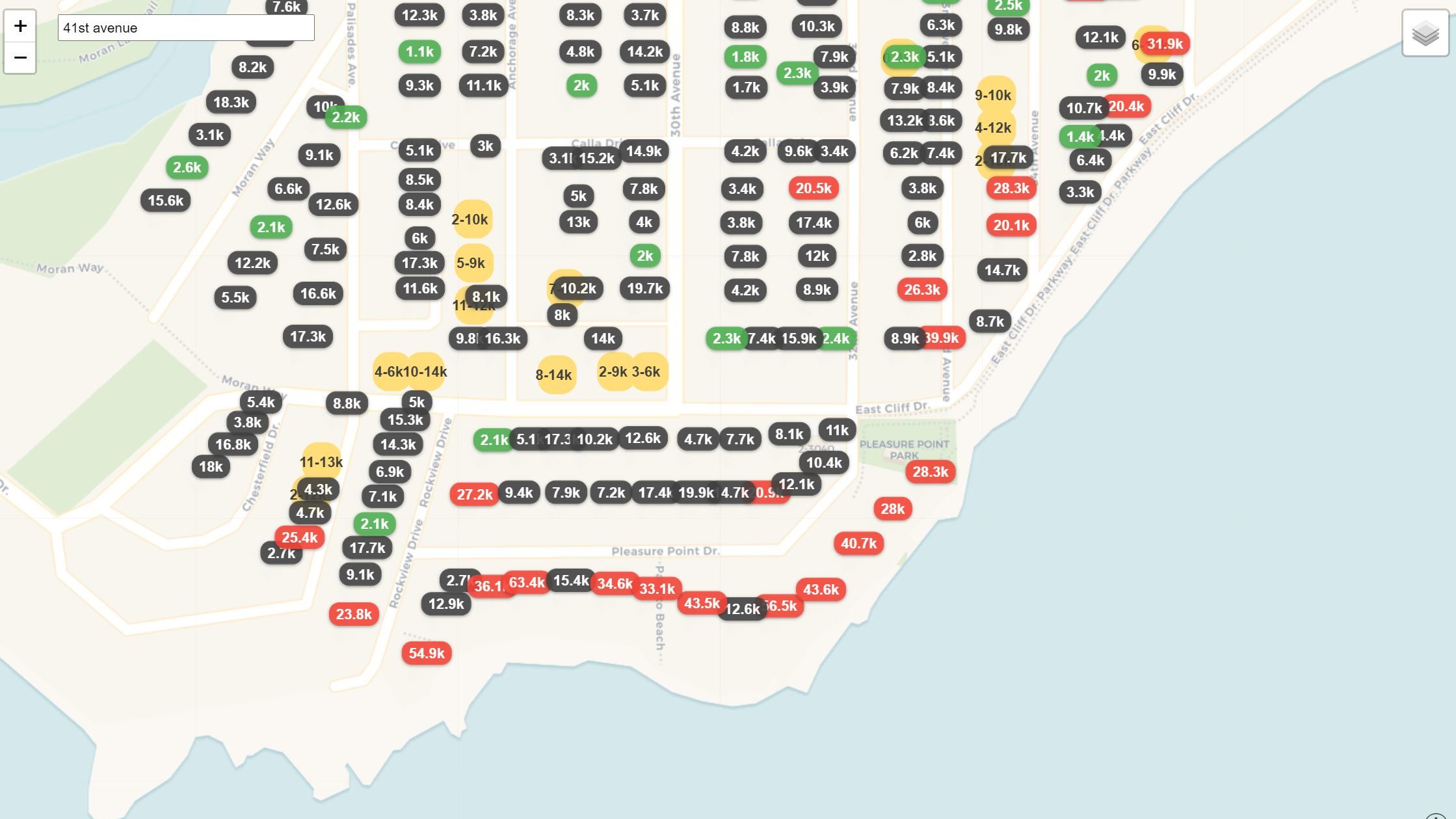

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local